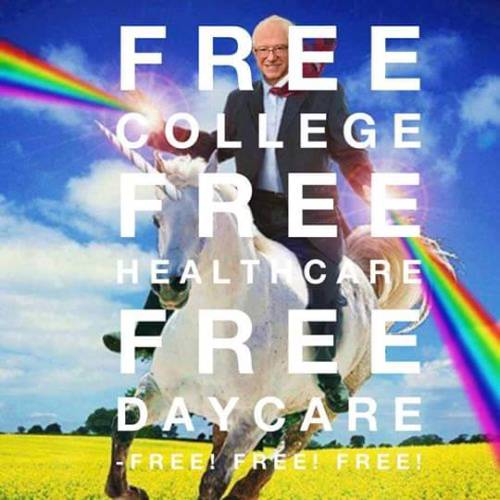

Bernie supporters know that all this "free" stuff isn't really free. Someone has to pay somehow. But is it true that all this "free" stuff means higher taxes? If you came here with questions, here are your answers.

UPDATE 1/13/16: Bernie's Campaign released a handy dandy chart on how his plans will be paid for and the revenue they are expected to bring in. Feel free to use the information there in conjunction of this blog post.

Tuition-Free College

Tuesday, May 19, 2015, Sanders introduced legislation to help make public 4-year colleges and universities tuition free, called the "College for All Act." You can view a newsroom article here, summary of the bill here, and the full bill here.

The bill would provide $47 billion a year to states to reduce college tuition and fees:

"Today, total tuition at public colleges and universities amounts to about $70 billion per year. Under the College for All Act, the federal government would cover 67% of this cost, while the states would be responsible for the remaining 33% of the cost." (bill summary)The College for All Act also proposes to cut student loan interest rates in half, expand student work-study programs, and create a pilot program to eliminate a student's need to apply for financial aid every year.

Funding for this legislation would come from a 0.5% tax on stock trades, a 0.1% tax on bonds, and a 0.005% tax on derivatives. "It has been estimated that this provision could raise hundreds of billions a year."

Universal Health care

The bill would establish a state-based health security program (and it looks like states can choose to opt out). The bill would also establish various organizations to develop procedures, evaluate quality, and perform research.

The bill would provide comprehensive health benefits (starting on page 17 of the bill) including preventative and long-term care. And as such, would eliminate health benefits under the Social Security Act (Medicare, Medicaid, Children's Health Insurance), the Federal Employees Health Benefits Program, and TRICARE. It would also repeal health insurance coverage and exchange provisions under the Affordable Care Act.

Funding for this bill (starting pg 166) would be paid by a 6.7% payroll tax on employers a, 2.2% - 5.2% income tax on employees (dependent on income bracket from less than $200k a year to over $600k a year), an 5.4% tax on modified adjusted gross income exceeding $1 million, and a .02% tax on securities transactions.

It is also worth noting that with all the programs Bernie bill would eliminate, the costs of those programs would essentially transfer to Bernie's health program, providing additional funding.

UPDATE 1/28/16: Bernie released official details on his health care plan including saving and taxes.

Green Energy Initiatives

|

| From FirstCarbonSolutions.com |

The bill proposes weatherizing 1 million homes per year (creating jobs and saving households on energy usage and costs), tripling the budget for ARPA-E, creating a Sustainable Technologies Finance Program to invest in green energy initiatives, investing in domestic manufacturing, funding $1 billion a year in worker training, and creating a family Clean Energy Rebate Program.

Funding for this proposal would be paid on $20 carbon tax per ton of carbon emissions, rising by 5.6% per year over 10 years.

"This fee would apply to only 2,869 of the largest fossil fuel polluters, covering about 85 percent of U.S. greenhouse gas emissions, according to the Congressional Research Service. The Congressional Budget Office estimates this step alone could raise $1.2 trillion in revenue over ten years and reduce greenhouse gas emissions approximately 20 percent from 2005 levels by 2025." (bill summary)Imported fuels would be charged the same carbon fee, unless the exporting country has a similar climate program and already charges a fee on carbon. The bill would also end fossil fuel subsidies. From this, "approximately $300 billion would go to debt reduction over ten years" (summary).

________________________________________________________________________________

Sanders also introduced a bill on Tuesday, July 7, 2015 to make solar energy more accessible to low income families, called the "Low Income Solar Act." This bill would cost $3 billion spanning from 2016 to 2030. You can view a news article here, summary of the bill here, and the full bill here.

Funding: This proposal gives the Secretary of Energy authorization to allocate an amount of funds ($200 million) each year from the Department of Energy for 15 years to provide low-income families with grants or loans (no more than 50% can loans, and they must meet certain eligibility requirements) to install solar panels on their homes.

Job Creation

|

| From ThyBlackMan.com |

The bill proposes to spend $1.6 trillion on rebuilding America's roads, bridges, railways, airports, waterways, ports, national parks, and electric grids from 2015 to 2022. Funding for this proposal appears to come in the establishment of a National Infrastructure Development Bank to give out loans.

______________________________________________________________________________

Thursday, June 4, 2015, Sanders, along with Jon Conyers, introduced legislation to create jobs for youth, called the "Employ Young Americans Now Act." You can view a press release of the bill here, a summary of the bill here, and the full bill here.

The bill proposes $4 billion in grants to state and local government to promote job growth and offer services such as transportation or child care to help eliminate barriers to participating in jobs. An additional $1.5 billion would go to local areas to promote jobs for low-income or disadvantaged youths. Funding for this bill seems to come from an allocation of funds within the U.S. Treasury.

Minimum Wage Increase

|

| From 10news.com |

This bill proposes the follow wage adjustments:

+ Minimum wage - $9 in 2016, $10.50 in 2017, $12.00 in 2018, $13.50 in 2019, and $15 in 2020.Business are expected to adjust their finances to cover this cost.

+ Tipped min wage - $3.15 in 2016, then increased $1.50 each year until matching standard minimum.

+ Youth min wage - can be no less than $3.00 less the standard minimum.

Others

Bernie Sanders also has proposals to reduce the deficit. These include:

+ End offshore tax havensConclusion

+ Establish .03% tax on Wall Street speculators

+ End tax breaks and subsides for big oil, gas, and coal companies

+ Establish as estate tax on inherited wealth over more than $3.5 million

+ Tax capital gains and dividends the same as work

+ Repeal 2001 and 2003 Bush tax breaks for the top two percent

+ Establish a currency manipulation fee on China and other countries

+ Reduce unnecessary spending at the Pentagon

+ Require Medicare to negotiate for drug prices

+ End mass incarceration (costs billions of dollars a year)

None of Bernie's proposals will raise taxes for average Americans, except for the health care bill. I don't know many people who make more than $200,000 a year. So consider that 2.2% income tax alongside what comes out of your paycheck for your employer's health insurance and what an average visit to the doctor's office costs (and then imagine what it costs for x-rays and surgery and things of that nature, and heaven forbid you have a medical emergency). Is 2.2% really that high? I've been told Briton pays 10%.

The top 2% of Americans will have some higher taxes. Taxes and fees will go up on large oil, coal, and fossil fuels companies. And Wall Street has a minuscule tax on its transactions.

When someone asks you how Bernie plans for pay for things, give them this article. And when someone tells you electing Bernie Sanders means higher taxes or increasing the deficit, tell them they're wrong.

UPDATE 09/19/15: various updates to funding info

This would be awesome. Bernie is for Us

ReplyDeleteit would be awesome. It'd be awesome if everything were free.

DeleteBut then reality rears its ugly head, and that unfortunately means we won't be getting free unicorns after all. =(

We've been getting free dead brown people for our tax dollars. I guess you'd prefer that.

DeleteTera253, read the bloody article. The reality is all there.

DeleteTera, did you even read the article? Like, even a little bit of it? Or did you just come here to be a knee-jerk naysayer?

DeleteEconomics doesn't use static math. Prices and behaviors will react to this policy and the outcome will not be good. This kind of manipulation never works. He identifies the problem but the solution isn't more Gov intrusion. That's what got us here.

DeleteCorporate power is what got us here!

DeleteRight. Mr. Full of conviction, Mr. Anonymous.

DeleteRight because it doesn't work for: Roads, Military, Libraries, Schools Elementary-Secondary, Universities State and Private, VA Healthcare, Food Stamps, HUD, Pell Grants, Stafford Loans... and hundreds of other programs. We all pay, the services are there, we all benefit. Wake up, we are already a democratic socialist country, and we are doing just fine. Maybe not as good as the countries with free healthcare, and education. We are behind them in almost every metric imaginable.

DeleteThe "free market" nuts make me laugh. They always claim they are the only ones who "understand economics". Yet "free market" never existed without cronyism except in theory. On the other hand what Bernie is proposing has either already successful existed in this country and people suffered for it being given up on (like free public college) or has existed for decades in all other developed countries (universal healthcare,living wage, free public college, paid maternity leave, two weeks vacation a year). It is your system that is unrealistic and "pie in the sky."

Deletetera...i'm sorry that some of us are not being very nice...the main po..int, i think, is to get those who are not paying their fair share to start paying so that we take care of each other instead of taking advantage of those who may need some help and when they are back on their feet, they will be able to help others...it's the way a society, a community should work. everyones success should be our own...that may sound idealistic,but it has to be better than whats going on now!

Deletetera...i'm sorry that some of us are not being very nice...the main po..int, i think, is to get those who are not paying their fair share to start paying so that we take care of each other instead of taking advantage of those who may need some help and when they are back on their feet, they will be able to help others...it's the way a society, a community should work. everyones success should be our own...that may sound idealistic,but it has to be better than whats going on now!

DeleteReally? Everyone wants something as long as THEY do not have to work for it. Welcome to Welfare Amerika.

DeleteThe hippies tried this in their free love communes. What shorty happened, half the hippies were out milking the cows and the other half was sitting under the shade trees smoking dope and shagging all day. The working hippies got fed up with feeding the freeloaders and left.

DeleteI want reparations for working my butt off my whole

Deletelife and never getting any of this free stuff. I'm in my 80's and live on social security and small savings.

Hello Everybody,

DeleteMy name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

Hello Everybody,

My name is Ahmad Asnul Brunei, I contacted Mr Osman Loan Firm for a business loan amount of $250,000, Then i was told about the step of approving my requested loan amount, after taking the risk again because i was so much desperate of setting up a business to my greatest surprise, the loan amount was credited to my bank account within 24 banking hours without any stress of getting my loan. I was surprise because i was first fall a victim of scam! If you are interested of securing any loan amount & you are located in any country, I'll advise you can contact Mr Osman Loan Firm via email osmanloanserves@gmail.com

LOAN APPLICATION INFORMATION FORM

First name......

Middle name.....

2) Gender:.........

3) Loan Amount Needed:.........

4) Loan Duration:.........

5) Country:.........

6) Home Address:.........

7) Mobile Number:.........

8) Email address..........

9) Monthly Income:.....................

10) Occupation:...........................

11)Which site did you here about us.....................

Thanks and Best Regards.

Derek Email osmanloanserves@gmail.com

It would be really great if you knew how to spell college. Not surprising you don't know many folks making more than 200K....

ReplyDeleteA 1,300 word article and all you have to say about it is two typos?

DeleteIts funny how when confronted with informatio that you don't like but you know makes sense you resort to undermining the writer over typos so you can continue to apply cognitive dissonance. You're not the first person I've seen do this either. So funny.

DeleteDon't be a baby Jed Davis. Grow up.

DeleteI don't know many people named Jed, either. The ones I do are usually pig farmers who failed fourth grade.

DeleteDon't be such a troll. It's a typo. The writer is a human being.

DeleteHonestly, I want to know where he plans to cut spending to work on the deficit, other than the defence and military budget? I see plenty of spend and tax, spend and tax, but no conserving of funds.

Delete^To answer your question, Unknown, Bernie will work to end mass incarceration. This costs us about $80 billion tax dollars a year. Cutting that down will definitely help with the deficit. Ending tax loopholes that allow Corporations or the super rich to avoid taxes also helps. You can find out some more here: http://feelthebern.org/bernie-sanders-on-the-federal-budget-and-national-debt/

DeleteJed - I have terrible grammar and syntax skills, but I'm smart enough not to vote against my own financial self interest.

DeleteWe don't need all prisoners out of jail. They just need to feed two meals a day like the rest of us. No free college, no computers, no exercise machines. Most of us don't have that why should prisoners.

DeleteUhm....most of us eat three meals a day. (Some, like me, a few more than that!) :)

DeleteSo what you're saying is, one dumb act, and they shouldn't be allowed to better themselves while they're locked up, then?

Right. YOU will support them for the rest of their lives then, right? What an idiot.

I guess if you ignore the fact that Bernie would like to tax investment transactions to fund the first two items (a Robin Hood Tax) this may seem okay. Or if you overlook the part where employers have to "adjust their finances" (code for eliminate positions) to afford their increased expenses, it looks okay. Maybe the part of the plan in which those transaction fees actually don't generate the revenue predicted (you'll have to look at the UK failire with the Robin Hood Tax if you want to inderstand this) it may still seem okay. The author not knowing anyone who makes more than 200K has no bearing on the economy, as those households are abundant and they own small businesses and mid sized businesses, and they work for large private companies and large corporations. All of those people losing money impacts folks working minimum wage jobs. We do not live in an utopian society, and there is still no such thing as a free lunch. Someone is paying. It seems to me that as long as the end user is not paying, they make a great Bernie Sanders supporter.

DeleteAnd the alternative? Don't even try to build plans to make things better, just keep on keeping on, right? At least Bernie has a plan. It's a pretty Damn good plan and looks like one he's spent about 30 years of his life researching and trying to put together. With top economists. As to your "end user" comment, I am a tax payer. I will be paying. And it's a much better plan than I've seen anyone else roll out. I'd rather MY taxes pay for universal healthcare rather than mass incarceration or corporate welfare.

DeleteIt's really very simple, if the wealthy paid the same rate of tax that the rest of the american people do , than the majority if not all of these programs would be payed for. How much money does one family or corporation need really. So instead of being trillioners, they would be billioners, or millioners instead of billioners. The wealthy, and big pharma are the problem in the USA, oh yeah&our big government, that's ran by big pharma and trillion $ corperations. Big money is the problem, and I do believe Bernie will be the one that makes them pay a more logical% of their profits.

Deleteif we eliminate government spending, there would be no taxes to collect

DeleteAs far as the payroll taxes are concerned... remember, companies already pay huge sums to insurance companies for worker coverage. if we were to implement these tax plans to give universal care, the employers would not have to pay those insurance premiums. I don't know exactly how much of a swin that would be, but it would certainly save many businesses money.

DeleteAs far as the payroll taxes are concerned... remember, companies already pay huge sums to insurance companies for worker coverage. if we were to implement these tax plans to give universal care, the employers would not have to pay those insurance premiums. I don't know exactly how much of a swin that would be, but it would certainly save many businesses money.

DeleteI think you meant to say "It is not surprising..." Maybe you should learn how to form a complete sentence. It's hilarious when an idiot tries to correct grammar and spelling with grammar mistakes.

DeleteWell, medicare costs over 600 billion per year for 50million enrolled. There are 350million people in America, 7 times! So Bernies medicare for all would be more than 4trillion a year. Taxing the Rich will not pay for that.your number are hogwash

ReplyDeleteBernie isn't taxing the rich to pay for Medicare for All. I'm pretty sure you didn't even read the article.

Deleteyou're right. he's taxing EVERYONE for that one, not just the rich.

DeleteFrom your very article:

"Funding for this bill (starting pg 166) would be paid by a 6.7% payroll tax on employers a, 2.2% - 5.2% income tax on employees (dependent on income bracket from less than $200k a year to over $600k a year), an 5.4% tax on modified adjusted gross income exceeding $1 million, and a .02% tax on securities transactions."

and as "small" as those numbers might seem, it's definitely not going to add up to $4 trillion per year by ANY stretch. Sorry Bernie. you need to go back to ECON 101.

We're already paying for most of that through the tax code's subsidy of private health insurance. What's (above and beyond) the most expensive tax break? It's the deduction for employer-provided health care, costing $760 billion over 5 years alone, with some estimates placing it over $1 trillion. With the ACA insurance exchange subsidies costing $238 billion over the same period, that's at LEAST $1 trillion going to subsidize the purchase of private health care over the next 5 years.

DeleteSince a single-payer system eliminates private health insurance for essential care, those tax expenditures would either be eliminated or become null, freeing up those funds in the general budget. And that's not even considering the indirect savings:

1. Using the tax code to subsidize universal health care has few built-in cost-control mechanisms that account for inflation, price gouging, or the cost-shifting between private entities that we have now. Since the federal government would have a monopoly on health insurance, hospitals, pharmaceuticals, and other medical providers, they would have very little leverage to negotiate high prices. This is why simple procedures like a hip replacement vary so greatly from state to state, and why virtually all medical expenses are astronomically higher in the US than countries with a similar system. The government would be directly covering costs, sure, but they would be a fraction of what it was covering through the tax code anyway. The only difference is it would have the power to directly negotiate prices down.

2. I can't think of a better economic stimulus for businesses than removing the burden of providing health care for employees. And since small businesses are typically the ones that cannot compete with the attractive plans offered by large corporations that can afford them, single-payer would be a tremendous boost for entrepreneurs.

Sources:

http://www.huffingtonpost.com/2011/04/18/the-top-10-tax-breaks-_n_850534.html

http://www.forbes.com/pictures/mjd45egfeg/10-insurance-exchange-subsidies-8/

Additional savings, provided by a study at the University of Massachusetts:

Delete1. $476 billion/year from cutting administrative waste of dealing with 1,300 health insurance providers

2. $116 billion/year from reducing drug prices to European levels

The researchers believe that with these savings, not only would it be enough to pay for itself, but benefits could be expanded to include dental and long-term care as well.

http://www.huffingtonpost.com/john-geyman/misinformation-about-the_b_8172086.html

Medicare is so expensive because we dont have universal healthcare. Of course medicare is gonna be expensive when the govt pays $300 for a $1 bag of saline or $80k for an operation that everyone else in the world pays 7K for. Some of you people act as if universal healthcare is some crazy liberal theory, when we are the only developed country on the planet doesnt have it.

DeleteTo follow you up Johann, a lot of them are also being consumed by the weight of their own system. We need a system that works yes, but I just don't want to see us follow the example of a failed system.

DeleteI'll be sure to get all the 80K operations i don't need when I realize I'm paying for them regardless of whether or not I get them. I'll be happy to know that accounting wise, money was saved somewhere along the line

DeleteAnon420: We are the only country in the industrialized world who does not have its own national healthcare system. The only one. And we are all losing $$$$ on the costs for not implementing one.

DeleteAnon420 you are not individually paying for any of the 80k operations unless your tax burden is a lot more than 80k per year. And some day you may need one of them. That is the whole point of universal health care. So that as a nation, we can all get healthcare. Unless you'd rather go back to paying out the ass for it. You're not going to pay MORE taxes for it unless you make over $200,000 a year. And even then, the savings from a single payer health care system would still make your out of pocket health care costs less than you pay now. Why would you argue against this?

DeleteApparently a bunch of morons also believe in unicorns.... seriously all these massive taxes and you expect job creation? Why work, all your doing is paying for other people's free stuff. It's actually horrifying that people this dumb - vote.

ReplyDeleteI believe in social justice. You keep what you earn, and I keep what I earn. If I choose to pay your bills, it's should be that - my choice.

Unless you work in Wall Street, you won't be paying for other people's college tuition. The tax on health care would be paying for YOUR bill as well as others, but we do that already as taxes go to public hospitals when someone who can't pay goes to the emergency room. There's really not much difference here, and the tax rate is pretty low. Unless you're a company with carbon emissions, you won't be paying for green energy initiatives. Where exactly do you think you're paying for other people's free stuff? Because you're not. In fact, raising the minimum to $15 an hour would take people off of social programs like welfare and food stamps. So you would be paying LESS for "other people's free stuff."

DeleteSomeone comes up with a plan to provide healthcare and college education to everyone in America, and all you can think about is you and your "earnings."

DeleteThis mentality is not necessary, it is misinformed, incorrect. selfish, and it is holding America back.

In addition to what the other guys said, universal healthcare enables millions of small businesses in Europe to operate without fear of what becomes a huge expense to anyone trying to hire employees in the States. Further, a government "free college" program already exists: the GI Bill. According to the CBO, it returns three dollars to the Treasury for every one it costs. Plus, imagine how much more money might show up in your paycheck when your employer no longer has to pay your insurance!

Delete@Greg Nelson: yeah, he came up with a plan, but not only is it a really shitty plan, but it's also not feasible.only 53% of this country pays taxes. why should they do the work for the other 47% who isn't doing a damn thing?

Deletesocialism fails to take human nature into account. People are not going to want to work if they can't keep what they earn. No one is going to want to work to help feed the guy who doesn't want to get off his fat ass and pull his weight.

The numbers you are throwing out are outdated, and skewed. There is, as usual, more to the story than someone just not pulling their own weight. But don't take my word for it...read.

Deletehttp://www.washingtonpost.com/news/wonkblog/wp/2012/09/18/who-doesnt-pay-taxes-in-charts/

That statistic came from the time of Mitt Romney's campaign right after the peak of the recession. Which was cause by good old conservative "fiscally responsible" Bush.

DeleteThat's funny so why work & make money if you are rich if your just going to be taxed. Tax rate of the rich was 94% under FDR & 91% under Eisenhower. Rich people worked, paid their taxes, & were still rich. Taxes are not necessarily a bad thing. I've got middle class relatives that pay 40% in taxes a year, while people like Romney & Obama released their taxes when they ran for president this last time & they paid 15% how is that fair? http://abcnews.go.com/Politics/eisenhower-obama-wealthy-americans-mitt-romney-pay-taxes/story?id=15387862#1

DeleteThink how much companies who pay for their employees insurance would save. It would free up billions for them. That would help the economy don't you think?

DeleteSIFL, Every Time you pick up a Telephone, turn on your Cable/Satellite/Broadcast Television, Connect to the Internet, Drive your Car on a Road, Flip on a Light Switch, Flush your Toilet, Call the Police, Ambulance, Enjoy your protected life courtesy of the Border Patrol, Coast Guard, Army, Navy, Air Force, Marines, County Sheriff, State Patrol, Check your Weather Report. Etc. You are participating in Socialism. You open your comment with an insult and follows it up with nothing but empty catch phrases provided to you over communication sources created and supported by Socialism. You sure do have a poor attitude about it.

Deleteyou're an idiot!! there, I just insulted you now!! it seems you republicans only know how to insult and ridicule people who have different beliefs than you!! you're the moron for your inability to debate something without insulting someone, go crawl back under your rock where the other idiots belong!!

Delete" seriously all these massive taxes and you expect job creation?"

DeleteSo when the top tax bracket was 90%, we IMMEDIATELY spiraled into a major depression, right?

Do a little homework instead of repeating the "fat cats"'s talking points. You make yourself look ignorant.

So "Socialism is for Losers" -- you keep what you earn, fine. better invest in a firehose, some private detectives, and maybe a few paving trucks and streetsaws with your earnings. You wouldn't want your hard-earned money to benefit anyone but you, right? Why on earth would you want socialist programs like a fire department, police force, or well-maintained roads? That's just craziness, you are absolutely right.

Deletewhy would i want to pay for things i don't need or want to use

DeleteYou don't drive on our roads, use our police and fire departments, attend our public schools, use our libraries, benefit from the hard work of our military, use our hospitals...? Are you dead? I don't get it.

DeleteEvery here of the G.I. bill? Yes that socialist program was a massive boon for the economy. Canada also implemented it with similar economic benefits after WW2. How is it that every major industrialized nation manages to have economic growth with universal healthcare and their healthcare is cheaper than ours?. You are the one that needs educating and I don't mean Fox news BS. You are stuck in the cold war where everyones a commie. It's stupid and not factual and your going to lose because this country will progress as it always has. Marginal tax rates were much higher during Eisenhower and the economy was booming in the 50's. It's trickle down that doesn't work. The game is already stacked at the top and when the deparity between the rich and poor gets to be too great your going to get a backlash. Correction when the disparity between rich and middle class become too great like now. Things are going to happen. The country has already been corporatized to death and its killing the backbone of the country. You will lose because you are always on the wrong side of history. America will progress. It always has.

DeleteReally? You realize that you have been getting "free stuff" your whole life, right? This nation is a socialized nation, you moron. The schools you attended were paid for by tax payer money. The police that patrol your streets are paid by tax payer money. Same with fire and emergency crews. The roads you drive on are maintained and built with tax payer money. It's all socialism. Better leave and find a country that isn't for you to live in. Good luck with that.

Delete"You keep what you earn, and I keep what I earn." Since 2008, every single penny of the "recovery" has gone to the top 1%. But most of the actual work for those dollars has been done by the bottom 50%. So, logically, with wages stuck at 1980s levels thanks to the "free market" system, it seems that the top 1% have been keeping what the bottom 50% are earning. And let's not forget that the infrastructure has been crumbling since taxes were dropped on those top "earners." The same top earners put the most stress on the infrastructure, so they should be paying more to fix it.

DeleteNot really sure what complaining about rich people gets you? Does it just help you people sleep at night? Just go to work, and move on with your life. Stop caring about other peoples paychecks and worry about your own. WHO THE HELL CARES

Deleteon the minimum wage and oil company benefits... ALL those additional expenses will be passed on to the end consumer anyway. Higher minimum wage at McDonald's = higher priced burgers. Reduced oil company tax breaks = higher fuel prices. NEITHER of those things are going to help create jobs.

ReplyDeleteAlso, many people will feel that they have no need to work, when Bernie will provide all these things for them anyway. AND, they won't be contributing ANYTHING!!! This level of socialism is GUARANTEED to create failure!

McDonald's pays a higher minimum wage in other countries and their burgers only cost 15 to 50 cents more. Higher fuel prices will be offset by a higher minimum wage and also green energy initiates, which will create jobs in that sector. You're also forgetting about Bernie's bills to create jobs. A higher minimum wage will also get people off of social programs such as welfare and food stamps.

DeleteUtterly wrong. McDonald's, like every other company out there, already charges every penny they think they can get away with. Raising minimum wage won't raise prices at all; it will thin margins slightly, but workers with more money means lighter margins are made up in greater volume. The net effect of all this is to divert some of the country's wealth from the coffers of millionaires and into the hands that create it in the first place, hands that will spend that money--driving the economy--instead of hoarding it.

DeleteLook at other countries that have minimum wages of 15 an hour, they only pay pennies more for their products. If McD can pay the people in other countries higher minimum wage, make money, & thrive in other countries they can do it in the USA too.

DeleteIt cost $$8.00 for a Big Mac in Poland and thats just the burger.

DeleteI don't know where you got that number, but you are very wrong. A big mac in Poland costs $2.54. And the highest cost globally is Switzerland at $6.82.

Deletehttp://www.statista.com/statistics/274326/big-mac-index-global-prices-for-a-big-mac/

DeleteIn Cuba everybody gets paid the same, the doctors and the garbage collectors, the same $20 bucks a month. When you try to make everybody equal, then everybody gets equally poor.

DeletePaying everyone the same amount of money has nothing to do with Bernie's plans whatsoever

DeleteIt's not an equation, dipshit. The only thing that would raise prices after a miminum wage hike would be the need to maintain the same amount of obscene profits. And since more people would have a choice of where to eat because they have more money, the competition would drive the prices DOWN not up. Everyone would thrive, as they do in most of the countries they have implemented a living wage. You're just wrong.

DeleteBefore you swallow the rise in prices that are being spoon fed to you, check the historical numbers of minimum wage hikes. Every time - yes, EVERY time - minimum wage was raised, it led to more employment, and a stronger overall economy.

DeleteGermany has free college for everyone. It also has a very high tax rate and all professors are paid the same, regardless of field. A little side note to that Germany has one college in the top 50 in the world. The U.S. has 11 in the top 20.

ReplyDeleteIt's not so awesome to have 11 schools that very few people can get into, at the cost of an educated population and all of the benefits that brings. In Germany, the crime and unemployment rates are also lower.

DeleteOnce you take things that you're paying in addition, like health care, tuition, and well-paved roads into consideration, the tax rate becomes very attractive.

Learn economics. Please, I'm begging you people, on my knees. Take a basic economics class.

ReplyDeleteWhat's in here that you feel defies basic economics?

Deleteknowing that you cannot legislate equality, perhaps?

DeleteKnowing that you cannot build up the poor by tearing down the rich. You're not going to build up the economy by robbing the rich and giving it to the useless.

Times in history where we had the greatest growth as a country, a rising middle class was when we were 'robbing from the rich & giving it to the lower classes'. Learn some history. We are in the shape we are in because the rich don't pay their fair share in taxes nor are working class people getting fair wages for what they owners are making & charging for products. Even Henry Ford understood you pay your people enough so they can buy your products.

DeleteThe top 1% currently pays 35.06% of the country's taxes... the bottom 90% pays 31.74%. Please tell me exactly how much you think is their "fair share"

DeleteThe top 1% control 40% of the US's wealth. The bottom 80% only control 7% of wealth. Yet, according to your numbers, their total tax contribution is almost the same. How is that fair?

DeleteIf Leftists understood economics they wouldn't be leftists. Better to believe the empty promises of an economically illiterate life long professional politician. - DrEvil007

Delete"giving it to the useless"

DeleteTera, what's it like to have such low self-esteem than you have to insult others around you to make yourself look better?

Me, I'd rather stand on my accomplishments than lower the bar so I don't have to work so hard.

YOU are the "useless" one, in the current scenario....

Rich, how do you justify calling someone out that is insulting others by in turn... insulting them? Your argument fails every time and most of your replies here (I say most because I haven't read them all) involve you insulting someone. Doesn't that strike you as hypocritical?

DeletePhilip, there are over 318 million people in the US. 1% of that is 3.18 million. 80% of 318 million is 254.4 million. That means for every person in the top 1% is paying 80 times the amount of taxes as the people 80% and under according to your numbers. So, yes, the percentages are close (the top 1% still being higher) but per person they are not even in the same ballpark. Also, where is the remaining 19% that apparently controls 53% of the US's wealth? If 80% really only has 7% of the wealth there is a big problem because that is far too many people with no income and even Bernie's initiative to create jobs will not cover half of that.

My final point to a lot of these standards that he wants to put in place is that they sound good in theory but you need to have people that actually want to implement them and be more than collectors from the system. Employees are an expense. If the cost of having an employee goes up then the cost of their goods or service will go up. This does not promote getting a job. Will the healthcare break make up for the increase in minimum wage? Perhaps but this still does not promote getting a job. He will create jobs, yes, but not enough to get everyone sitting at home doing nothing to get up and off it (you can't fix lazy). His plans do not encourage people to stop doing nothing. It just improves the situation for the people that do a little.

I love how, instead of arguing for their position conservatives just call anyone who disagrees with them uninformed. Classic tactic of the ignorant, and brainwashed.

DeleteYes, there's a cost for employees. What's the cost for customers?? Believe in the capitalistic economy. If wages go up with the product, we will see competition.

DeleteI am so sick of being called "Lazy"! I worked since the age of 15 in the fields...then at 17 I became a Certified Nursing Assistant...I worked for 16 years as a CNA...then I went to Nursing school and graduated with Honors as a Nurse...I was a Nurse for 10 years before taken off work because of Fibromyalgia, Sciatica and a mirage of other conditions...most of them I had worked with for the last 15 years of work. Four specialist told me that I needed to stop working...The Doctor I worked for told me she was taking me off work because they couldn't control the pain and other debilitating symptoms I had. I struggled to keep me job that last 5 years...I left crying, kicking ans screaming because I wanted to continue working and just couldn't accept the fact that my body wasn't cooperating anymore...I didn't have any trouble getting not only SSD, but my private disability insurance moneys. I AM NOT NOR EVER WAS LAZY!!!! Thankyou! I just had to get that out to let you know that not all of us that are not working are lazy! There are those of us who would love to be able to work, but their bodies will not allow them too...

Delete^My mother went through the same struggle. The stigma of being called "lazy" for her Fibromyalgia that made it difficult for her to work pushed her to make herself work even when she shouldn't have. When she finally admitted defeat and applied for disability, her body was worse off than it had ever been and the doctors doubt she'll ever recover. That's where "lazy" gets you. People are so ignorant of other people's struggles.

DeleteI'm very sorry to hear that about your mother...so sad. Many people who do not work, can't...although I know their are also those out there that are just lazy...I know a few. But to just put us all under one stigma is so very wrong and shows how ignorant some people are. I was a Hillary Supporter, but have recently changed my mind..not because of all the free stuff but because of the real unequality in this country. I know that he may never get all this stuff passed, but if he even gets half, it will change a lot of the unequality in this country...go Bernie!!!!

DeleteI know there's people who cheat the system too. I have a cousin whose throat fused due to diabetes that wasn't managed properly. They could have done surgery to fix it, but her parents decided not to so she could collect disability when she turned 18. She has a permanent trachea now. I know there's crappy people out there. But that doesn't mean the system doesn't help people who need real help. That doesn't mean there aren't good people who work hard and deserve the assistance they've paid into their whole lives.

DeleteI'm fighting for my SSD right now same exact issues as you, I babysat from 13 to 18 then did odd jobs. I became a CNA when my girls were 2 and 3 but after hurting my back repeatedly and a knee injury, I had moved into home care until they had to force me to stop working, I also cried my last day of work. I'm glad you put this out there.

DeleteMr. Bernie Sanders, are you listening? Your "pie-in-the-sky" ideas sound terrific IF we were all on LSD or stoned on pot. Your plan for bringing these celestial visions to fruition is to

Deleteraise taxes? Politically-inspired dreamers and visionaries. American history has seen them all. Making starry-eyed promises that you cannot keep. And, you know it! Getting all of these egg-headed and very green collegiate types to swim in the idyllic waters of your mirage. I watch them at your rallies; gazing all glassy-eyed up at the heavens as you mesmerize them with your dream-like rhetoric. You should be ashamed of yourself. It almost borders on "child-abuse". Almost like the reverend Jim Jones dispatching Kool-Aid to those poor and gullible souls.

Please cease and desist with your morphine-like BS, Mr. Sanders!

Crickets.

ReplyDeleteThanks for your excellent summation of Bernie's plan. I LOVE his goals, but was concerned on how he would pay for it. Feelin' the Bern!

ReplyDeleteI'm glad you found it helpful.

DeleteSo when you say .5 percent do you mean 1/2 of 1 percent?

ReplyDelete.5 means 1/2 so yes that's what they mean

DeleteWhat else would it mean?

Delete50 per 100

DeleteIn a provocative challenge to both the Left and the Right Sen. Sanders concluded, “As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world. This is a clear case of socialism for the rich and rugged, you’re-on-your-own individualism for everyone else.

ReplyDeleteBelieve it or not, the majority of us would prefer to be left to our own devices

DeleteT - I disagree

Deletesource: I am a bank

ITT: people who don't understand how money works who are just gleefully jumping on the Bernie Bandwagon because he promised them free stuff.

ReplyDeletebecause god forbid people actually get to keep what they earn. I know best how to use my own money, not some corrupt suits up in Washington.

Are you using your money to hire your own private police force and fire department? Do you use your own money to personally pave your own street? Have your children ever attended any form of public school system?

DeleteDon't bother replying, they are rhetorical questions. By your own logic, you are getting free stuff that other people have helped pay for out of their earnings. Thanks for playing.

God forbid you or your family ever have catastrophic medical costs or lose their job, ultimately causing you to lose your home and requiring welfare. God forbid you have to start over and need help and access to basic human rights. God forbid you are born into poverty and resort to crime because people like you won't help and you see no other way out. They don't want your precious money; they want a chance.

DeleteHigher IQs.....that'd be great!!!

ReplyDeleteTax Wall Street ... Rebuild Main Street'

ReplyDeleteI am so sick of seeing people from 3rd world countries with beautiful dental work,,and better general health care all their lives,,, than the average American. Of course it is NOT FREE,,thier health care is supported by their taxes. What an Idea,,, citizens taxes being used for citizens.

Now who does my taxes support,,,,, Exxon Mobile,,,Wall Street,,and the war machine.

Which 3rd world country are you talking about? If they are in better health it is probably because their diet does not include all the fake food we eat in the US.

DeleteI am all for public healthcare and free education but I think this is over dramatizing.

If you raise the minimum wages and businesses have to adjust their prices go up. If you tax carbon like gas prices will go up to cover that cost. Who do you think pays that cost. The everyday worker.

ReplyDeletebut now your gas can pay for someone's health as well, think of the billions you will save

DeleteThe answer of how to pay for it is simple and elegant answering environmental, economic, and social mandates simultaneously.

ReplyDeletehttps://www.indiegogo.com/projects/urban-agriculture-and-energy--2/x/10003213#/

Anyone that honestly believes the rich are paying their share needs to revisit their economic courses. It's not about percentages.

ReplyDeleteAs someone who would stand to be paying more under these taxes, I think it's what we need. I've chosen a lifestyle that's based around low income. I understand what it's like to barely be able to support yourself, pay your bills, and dread getting sick. Many employees work full time at jobs that barely let them get by without government assistance.

It's the duty of the rich to make sure that doesn't happen. They make their millions on the backs of the workers. America is not the great country it used to be, because the working class isn't treated the way they need to be.

And for the people that still think it's fair for the rich to keep 'their' earnings, business would only improve if more people could get schooling. More foreign money in american pockets means more people buying goods and services.

Wow! It's the duty of the rich to give you a better life?!?! WTF?!?! How about it's YOUR personal responsibility to ensure you can have a better life, NOT taking away from others who HAVE done better for themselves. People come to this country by the droves every year for a better way of life, and many seem to do just fine. Yet we have a bunch of cry baby lazy ass leeches who expect the government to take from others to give THEM a better life. What a bunch of nonsense! Our country is FULL of examples of people who started off disadvantaged and made good lives for themselves...but somehow some people just can't seem to find the drive or motivation to do it for themselves. And we're supposed to take pity on them?! And those people who have acquired the schooling, skills, and resources to become successful and wealthy should be part with their money even more to enable others to become even bigger leeches?! How does this even make sense to anybody?!

DeleteI was going to say same thing. Let's look at people who spent their high school years goofing off and didn't get into college and now working at McDonald's for minimum wage, versus a CEO who studied hard in high school, college, and worked their way up ladder. Why should their decades of hard work pay for those who just got by doing the minimum.

DeleteWho both went to public schools funded by taxes, on roads built by taxes, at school lunches funded by taxes, took pell grants and stafford loans funded by taxes, so they could work for companies subsidized by taxes, for rich people who don't pay taxes. Brilliant.

DeleteYes Christopher, they both went to public schools...then what happened? There are rich kids out there with every chance in the world that end up broke and stupid. You cannot make people equal.

DeleteUnknown, Did you even read his whole comment, he states that he would have to be one of those who would have to pay the higher taxes which means he's making over $200,000 a year which means HE HAS A JOB!!!!!! You are telling a person who would be paying the higher taxes he's lazy, you just made yourself look like an ID10T.

DeleteFascinating! Thanks for the information contained within your article.

ReplyDeleteMay also want to add the 0.2% payroll tax to pay for family and medical leave.

ReplyDeleteWhat bill did I miss that on?

DeleteCan you point me to the section of the bill that states information of this sliding income tax scale of 2.2 to 6.7%? All I found was a straight 6.7% income tax. That's huge. Freakin huge. I don't use my health insurance much at all. I have seriously no interest in spending THAT much money on something I don't use. Id be happier at 2.2-3% at my current income levels but not almost 7%.

ReplyDeleteThe sliding scale you are looking for is on page 170 of the full pdf of the health care bill

DeleteUmm....the current tax paid for Medicare (which would be eliminated under the plan) is 6.2% for the employer AND 6.2% for the employee. That would be eliminated, so you're actually looking at an employee's contribution going up by 1/2 of 1%. Which would be more than offset by the elimination of their share of insurance premiums.

Delete51% of Republicans believe the only reason people are poor is because they are lazy

ReplyDelete100% of Democrats believe people are poor because someone else didn't give them enough

Delete100% of democrats would rather the poor be poorer granted the rich were not so rich

DeleteOh, it all sounds like magic money from the sky, doesn't it. Until you decide to start a business and borrow heavily to try to make the business work and then hit the $200k mark expecting to pay back all your loans, and Bernie sucks all your money out of your pocket. Guess what people, the entrepreneurs who create EVERYTHING in this country will simply walk away if they can't earn back enough money to make their new ventures worthwhile. You will all be stuck paying 50, 60, 70, 80, 90% tax rates because NOBODY is going to work their ass off to try to create a business in this country anymore if they cannot earn back what it costs them to create the business. There is not a country in the world that has made Communism work, and Bernie is leading you down that same path. Do you really want to be the next North Korea? Do you really want to be the next Cuba? DO you really want to be the next failed socialist experiment? Well I don't. I'm an entrepreneur, and I build things in this country. I build things because I expect to make a lot of money from what I build. If you want to sit on your ass and wait for things to be handed to you, then enjoy yourself, because you're not getting it from me. Said the Little Red Hen.

ReplyDeleteBut wouldn't paying back loans actually be considered a business expense thus lowering your net below the 200k? It could just be me but I thought a business deducted it's expenses and depreciations before it figured it's tax rate.

DeleteYou are right, and only an entrepreneur will ever understand that. Socialist are all a bunch of Monday Morning Quarterbacks, always have a better play while they sit on their asses,

DeleteMy most recent payroll deductions, after I pay taxes and insurance premiums, leaves me with around 55% of my gross pay. So, I'm already paying close to that 50% tax rate in reality.

DeleteThe funding for “free” college comes from a new trade tax on the stock market? So, in other words, we still pay for college with our retirement savings. Mutual funds will therefore deliver lower returns overall, because every adjustment to their portfolio will cost them the trading costs PLUS tax, and over the course of your (the average investor’s) lifetime, an average difference of 0.5% per year will end up costing as much or more than your college tuition if you had just paid for it directly. Bernie will not make college free for anyone. He’s just re-directing the costs so that you don’t realize you’re paying for them, dearly.

ReplyDeleteThe funding for the health care bill will be paid by ANOTHER tax on employers? The very ones that are also supposed to find some way to nearly double their minimum wage in five years? This is pure recipe for layoffs and higher unemployment, which will spiral into higher prices, lower aggregate demand (since overall, people will have less, not more, to spend), which results in lower expected earnings for companies, which flows over into less investment, which, at best, will stall the stock market, and more likely throw us into an entirely renewed and prolonged recession. It will, as the left never fails to accomplish, continue to consolidate power among the top 1%, and root out prosperity among the poor and middle class.

Bernie is either ignorant of basic economics, or he is beguiling the masses into granting MORE (not less) power to the upper elite by rooting out opportunity and eliminating the middle class.

The recession has been blamed on speculative trading by Wall Street. The tax on Wall Street is miniscule and carefully calculated to reduce reckless spending and not effect the investments of Average Americans. http://www.sanders.senate.gov/newsroom/recent-business/robin-hood-tax-to-reduce-wall-street-greed

DeleteThe funding for the health care bill is a tax on employers. However it replaces what employers currently pay to provide health benefits for employees and could actually comes out less with today's rising health care costs.

Yes, because its so much better to have a five or six figure college tuition debt accruing interest at 7% and not pay fractions of pennies on the dollar on investment gains. I gotta tell you, as a millennial, most everyone I know isn't saving for retirement AT ALL because they can't afford it with the $1000+ monthly student loan payments. When I have enough extra money that the taxes on retirement earnings equal the ~$600 monthly that loans accrue, I will consider myself lucky indeed!

Delete@Berniementum how can spending be reckless except by the government? isn't this whole plan reckless?

Delete@Anonymous this plan forcibly LOWERS college interest rates, that means you will be encouraged to keep your student loans longer instead of paying them off, and colleges will be encouraged to charge you more in both the short and long term

So many clearly knee jerk reactions from people who clearly either didn't read, or didn't understand the article. These "evil socialist policies" that would destroy businesses are the reason Denmark is one of the best countries in the world FOR businesses. Do your homework, and try to have a global, historical opinion about this. It's clear Reagan and Ayn Rand have done terrible damage to this once great nation.

ReplyDeleteWhat are the Republicans offering? What will they do to help the middle class? So far I have heard only hate speeches, get more guns and more versions of trickle-down economics, isn't that how the rich got richer and middle america got poorer, isn't that why we have close to 25,000 people getting shot every year? GOP candidates are falling over eachother to out-hate the others, to create fear and hate and violence in america, hum.. I like Bernie's ideas better, I will vote for Bernie Sanders.

ReplyDeleteIt all sounds good. Just remember, corporations almost always pass a rise in taxes/fees onto their employees and consumers. So in the end, this likely means cost increases for the "average Joe".

ReplyDeletesays you.

DeleteSays economics.

DeleteSo, if some businesses raise their minimum wage WITHOUT raising significantly raising prices, which we know is possible b/c some already have, while the ones that are screaming about how they will have to raise prices do and are no longer competitive with the companies that weren't using threats to keep from paying their workers a fair wage, what happens to prices to consumers then? Is the claim that costs to average people will go up a permanent problem or a temporary problem that the competitive nature of business will work out?

DeleteNext year, I will retire from the Army after 22 years. When I joined I was promised health care for the rest of life. How will this health care reform affect Veterans?

ReplyDeleteWell, if they were smart, they would take the portion of the defense budget that pays for the veteran's healthcare and move it to the Single payer system. The veterans's would then be guaranteed the same level of healthcare as the rest of of the US instead of being dumped back into the country and ignored.

DeleteI imagine that once your healthcare post-retirement, was under your control and not going through the VA, it would be better than what the overwhelmed Armed Forces are doing today.

I would think it means you still get healthcare. I mean, isn't that the idea? All Americans would have health care and would not be getting bled dry for it. Yes, businesses would have to pay a tax to cover, but I know it would be less than the expenses they are burdened with by having to provide private insurance. There is a reason our insurance costs keep going up every year, yet the level of service provided keeps going down.

DeleteYou will probably get the same insurance as us...I am not a fan.

Deletedon't worry.....you can stay where you are. uncle Bernie not getting elected and you put your ad in the wrong place

ReplyDeleteThere isn't a single thing that's been privatized that hasn't been ruined, water quality from the tap has been progressively worse over the years, prison populations are out of control, Insurance costs are ridiculous. Every time we privatize something the cost of it skyrockets, monopolies are formed, and it becomes inaccessible to the average citizen. When are people going to learn. We are the government, if we can take control of Insurance and education, we will call the shots. There is no part of this that is unappealing to an educated person.

ReplyDeleteOne thing that is never brought up, even by him, is that college graduates pay more in taxes. A community college costs the government an average of $9,000. A graduate pays an average of $79,000 more in taxes over their working life. Most investors would jump at an investment that costs $9,000 and returns $79,000 over 40 years.

ReplyDeleteIn Denmark, the "private sector"(Corporations/Unions),created and put in place a minimum wage of $20.00 dollars an hour!, without Government intervention! That is the way "free markets" should work, should they not! Denmark is consistently recognized as having the "Happiest People" on Earth! If and when their Government is needed to "intervene", their Government does! I beleive, and I feel/trust that Bernie does also, that United States citizens should be as happy or, for that matter, be the "happiest" people on Earth!! That the "Corporate/Union/Private" sector of our country has failed, and is failing miserably, toward that goal, means our Government ("forthe People"!?), needs to intervene for our betterment! If,as some complain, poor people are "lazy,sitting on their asses,and getting a free ride!",then let us change that by motivating "them",and incentivating "them" to earn their "keep",through an expansion of the earned income credit! Make it gaurantee all citizens, full time workers, receive $22.00 an hour for their being a part of the citizens workforce of our Nation!? A forty hour/week, 2080 hour/yearly, equals full time work right now in our Country!(Although I think it should be less; more like 30 to 35 hours a week,or 1600 to 1800 hours a year!) Toward a goal of "sharing the workload" more resonably in view of the fact that the 40 hour week at straight time wages is about 80 years old, and in which time productivity and technology have progressed exponationelly,time and one half pay for work exceeding 6 or 7 hours a day should be implemented by Law! All Income from wages and earned income credit would be fully taxable as if all were wages! (FICA-payroll taxes,and federal/state income taxes,so as to make sure we all contribute to directly funding our Government functioning, in a progressive taxing system! This would be an excellent start toward a Just and fair/equitable economic system,that promotes a good work ethic,unity, true Patriotism,strengthin the "Fabric" that holds our Nation together!,etc.,etc.!My spouse and I so strongly believe in this that we have contributed $300.00 to help support Bernie ! We are now challenging our fellow American Citizens to step up and do the same by sharing of their Wealth to a point of hurting a little, but not harming yourselves!! Implore and demand and beg(if necessary), your family and friends to do the same,and to register to vote!,and make sure you and they do vote!!Together, we can make it happen and will make it happen!! Demand that every office seeker give their signed pledge/promise to vote Bernie's and our Visions & Goals into LAW of the LAND!!! (refuse to vote for anyone who is unwilling to sign the pledge!!(Truly put their "Money where their Mouth is",and "Walk their Talk",or get out "off the stage" and "out of the way"!!!) Learn the Berne! Feel the Berne! Get Berned up and change our Nation for the betterment of all of US and the future of this Beautiful-- UNITED STATES of AMERICA ( We need to UNITE!! )

ReplyDelete"Socialism" has become necessary due to the increasing insecurities of the destroyed middle class but socialism alone will not rebuild our industries or create the wealth we need if we are to reverse our historic decline into becoming a 3rd world nation. Although these benefits and some redistribution are warranted and therefore Bernie’s platform has merit, I think it is unbalanced because it doesn’t address the need to grow private sector manufacturing that is the engine of wealth-creation in a modern economy. Ultimately we need to rebuild our industries if we are to have the long-term prosperity these programs represent.

ReplyDeleteTherefore Bernie also needs to define a REAL trade policy in our national interest. "No TPP" is necessary but we have no TPP now and yet since the WTO and NAFTA treaties formally opened our Free Trade policy, the USA has lost over 4.5 million manufacturing jobs (while our population grew by 62 million). From Jan.2001 through Dec 2013, the BLS ran a data series counting the number of manufacturing establishments (factories) in the USA, which showed a loss of 63,879 factories before the data series was discontinued. Over the past 11 years our annual merchandise trade deficits have averaged over $720 billion, and cumulatively since WTO/NAFTA it has totaled over $11 trillion. This represents a huge loss of American economic activity, and is the main cause of our stagnant and declining real wages. The industries and jobs lost due to off-shoring and out-sourcing are a huge loss of tax base, resulting in fiscal crises at all levels of government. And the losses are not just quantitative: these lost industries mean a dismantling of the industrial ecosystem of supply chains, human skills, technological leadership and all the multiplier-effects of manufacturing. In sum, we are losing the industrial base that took generations to build and that is the source of American prosperity and power.

President Sanders should find members of Congress from both parties to introduce and support a Balanced Trade Act that limits our imports to the same value as our exports. Diverting our $720 billion annual merchandise trade deficits towards that much more US-made goods would directly create 6 million new US manufacturing jobs and indirectly, through the multiplier-effect manufacturing has, another 8 million new US jobs in other sectors. That would create the new wealth to put real value in our wages and rebuild the tax base and our industries essential to long-term prosperity. Here is model legislation that would make it happen:

http://www.balancedtrade.us/#!balanced-trade-restoration-act/c43o

Yes.

DeleteYea,Poland isn't the example that we are talking about. No one ever mentions that raising the minimum wage also increases the amount of taxes that are being paid. Millions of people will be lifted out of poverty and social programs and will also consume more and pay more into the tax system. im not going to call you stupid,because you probably didn't purposely overlook the finer points. Or did you?

ReplyDeletecorrection in Carbon Tax section:

ReplyDelete"Imported fuels would be charged the same carbon free..." should read "carbon fee"

Thank you.

DeleteSure. Everything makes sense. In theory. You are correct also that taxes are not increased except for the health care. But... you're taxing the crap out of everything else. What's to say that the businesses that he wants to tax will not increase their cost of the end product?

ReplyDeleteTax the fossil fuel polluters = higher gas prices

Increase payroll tax to the business = higher end-product prices to the consumer

Higher minimum wage (cost on the business) = higher end-product prices to the consumer.

So no, the taxes are not going up, but everything else is. What you still don't seem to get is that SOMEWHERE along the line, the costs to the consumer HAVE to go up. Somebody has to pay for it. Big corporations are not going to cut into profits. I know I'm not.

If every single business raises their prices because they have to pay more tax or pay a higher minimum wage, then what you say is true and prices to consumers go up permanently. But not all businesses are raising prices to support raising minimum wage. How does that affect the raising of prices to average consumers? If a company is paying a living wage and still not charging significantly more for their product or services when others are, who do you think people will want to work for or shop with? How will other companies compete?

DeleteIs you're argument really that we cannot change things that NEED to be changed because businesses will screw us over? Because maintaining the shitty status quo because we're controlled by the threats of private industry hardly seems like the way I would prefer the country be run, which it is now. Are you content with that?

This is a good blog page. But, the tip most photo meme that shows Bernie riding on a unicorn with rainbows is counter to the message and should go or be changed to a positive image of Bernie. The unicorn image is used by right wing and conservatives to make fun of Bernie's proposals, and it has no place on a page devoted to a serious discussion of his proposals.

ReplyDeleteI actually wrote this post in response to the image as evidence that Bernie's plans aren't unicorn rainbow farts and have actual legislation and funding plans attached. So... I don't know. I personally feel it has a place. But I do get where you are coming from.

DeleteAll this stuff is nice and all,but what happens when all of these large companies decide to just move elsewhere to avoid these exorbitant fees?

ReplyDeleteI mean $250k a year isn't a ton of money in the big picture of things. Plenty of small business owners can find that to be fairly achievable and even some higher end engineers can make that. They will end up getting stuck with the brunt of this when the huge companies take care of avoiding these taxes.

I find it sad that everyone my age is falling for the BS Bernie is selling.

Simple: Close the tax loophole that many corporations are using anyway. They move their "headquarters" to another country. They then declare themselves to be a foreign company, exempt from U.S.A. taxes. So, just pass legislation that would tax their U.S.A. income as if they are a U.S.A. company. If they want U.S.A. business, they pay U.S.A. taxes. And the same tax rate should be charged to overseas companies as well, not just the ones leaving the country.

DeleteBS?....and the republicans have what for you?

ReplyDeletehow about making the 1% pay their fair share and getting rid of corporate welfare...I would say that's a heck of a start

ReplyDeleteyou like the idea of Social Security?....you've been paying into it for a long time I bet....elect the Democrats if you want to keep it...

ReplyDeleteI'd prefer to opt out of it and invest that money myself but I guess the government, especially under Sanders, would never allow me to actually take home that earned money before I'm old and gray.

Deleterepublican creeps have nothing for you and I...except 2008 all over again...

ReplyDeleteand by the way, where did Cruz, Rubio & Carson come from?....magically appeared to be the puppet if they get elected...they never did a thing worthwhile....oh yah, Cruz voted to shut the gov't down to the tune of 17 billion...

ReplyDeleteThe government probably spends 17 billion too much anyway

DeleteSo employers will pay a 6.7% payroll tax? What does that mean for employee wages/salaries on top of a 2.2% income tax for healthcare?

ReplyDeleteI've asked that question myself. Unfortunately, it's really difficult to find data on how much employers spend on healthcare. All I have found is that say employers take on about 50%-80% of employee healthcare premiums. But how does that relate to what they'd spend in payroll tax under the new plan? I don't know. The numbers just aren't out there.

DeleteWell, if my employer is paying 50% of my premium, and my premium is 13.6% of my pay, plus we both pay 6.2% for Medicare for a total of 19.8% each, then 6.7% for each sounds pretty good to me. I end up with an effective 13% lower tax rate! Which I can use to buy more goods (which I am sure - wink wink - would cost 13% less, since the employer saves the same) or invest.....which sounds strangely like economic growth.....

DeleteI'm in support for many of Bernie'e proposal's, making this country more equitable and affordable. Honestly we don't know the effects of any one of the proposals until it gets implemented in the US. Maybe supply and demand works if minimum wage goes up. More people have money to buy/spend so prices do not increase. Or since companies have more taxes and pay higher minimum wage, prices increase so consumers suffer. We don't know. Again I feel something needs to be done. Just something to think about if minimum wage increases all the way to $15 and benefits are free/reduced then so many Americans (non education seeking) will be satisfied and living comfortable. What will be the future drive for students/people to earn degrees and get higher educations in order to continue building entrepreneurs, engineers, doctors, lawyers, etc. discovering what has not been discovered yet. I have a bachelors and masters degree, an educator for 16 years, make just over a beginning teacher, which equates to not too much more than everyone else that would be making $15/hr. Will we still push and encourage post secondary education? Will the salary reflect above that of minimum wage? We still want our country to grow, express the importance of education/trade, produce innovators and be at the top and not just settle for the minimum. Just a thought is all.

ReplyDeleteSo raising minimum wage that high concerns me and almost encourages no education needed. McDonald's, Publix, Walmart, cashier, etc don't have to have diplomas, well maybe some might. I feel there is no incentive for furthering your education, just getting minimum wage, and is that only what we want?

ReplyDeleteWe already have a lot of people with college degrees working "skilless" jobs. In part because the job market is so poor. But other people are really good at working in the retail or food industry and work their way up to manager. What's wrong with that? I mean, if every single person in this country had a higher education we would still need people to work at McDonald's, Walmart, Pizza Hut, etc.

DeleteI reject the idea that furthering your education is a requirement for personal fulfillment. There are several jobs you can start at the bottom with no special training and work your way up without a diploma. And if someone wants to go that route, they should. There a many people out there who get a college education and then decide to go into a completely different field of work. How useful is a college education then?

Furthermore, the desire to get an education is not entirely money related. When you were a kid, what did you want to be? Many people get an education because they have a chosen career they are passionate about, not because of the salary they think they'd make. Others just want to learn. The minimum wage does not need to factor into that.

Have any of you Trumpsters/Hillbots ever heard of Robert Reich? Do yourself a freaking favor...before your dumb ass says another word about how Bernie can't do the things he's proposed, or present us with your brilliantly Corporate American GOP propaganda or your 3.2 GPA Business Degree that assures that it will never work,...get the rundown of the math of Bernie's proposals from Reich. (ROBERT B. REICH is Chancellor’s Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center for Developing Economies. He served as Secretary of Labor in the Clinton administration, for which Time Magazine named him one of the ten most effective cabinet secretaries of the twentieth century. He has written fourteen books, including the best sellers “Aftershock, “The Work of Nations," and"Beyond Outrage," and, his most recent, "Saving Capitalism." He is also a founding editor of the American Prospect magazine, chairman of Common Cause, a member of the American Academy of Arts and Sciences, and co-creator of the award-winning documentary, INEQUALITY FOR ALL).

ReplyDeleteSo,...what are your credentials?

Everything makes sense. In theory. You are correct also that taxes are not increased except for the health care. But... you're taxing the crap out of everything else.

ReplyDeletepayroll company

job search websites

ReplyDeletefind a job

jobs hiring

career

job openings

job opportunities

job websites

security jobs

job search sites

job vacancies

looking for a job

ReplyDeletejob seekers

recruitment agencies

job listings

employment agencies

job application

job hunting

retail jobs

job postings

placement paper

Hey I am so grateful I found your site, I really found you

ReplyDeleteby error, while I was browsing on Digg for something else, Anyhow I am here now and would just like to say thank you for a incredible post and a all round enjoyable blog

payroll services new jersey

Cpa Consulting in new jersey

Read your blog and its really informative keep updating with newer post on health insurance plans

ReplyDeleteWow, what a blog! I mean, you just have so much guts to go ahead and tell it like it is. You're what blogging needs, an open minded superhero who isn't afraid to tell it like it is. This is definitely something people need to be up on. Good luck in the future, man

ReplyDeleteoffshore company formation video

Simple trick to cut your power bill by 75%:

ReplyDeleteWant to know how to easily produce all of the renewable energy you could ever want right at home?

And you’ll be able to make your home totally immune from power outages, blackouts, and energy grid outages…

so even if everyone else in your area (or even the whole country) loses power you won’t.

VISIT THIS SITE: DIY HOME ENERGY

Very good article! We will be linking to this great article on our website. Keep up the great writing.

ReplyDeleteCalgary Daycare

Thank you. We are glad you like our blog. Check back for more interesting topics soon.

ReplyDeleteTax Planning Barking

Hello Everybody,

ReplyDeleteMy name is Mrs Sharon Sim. I live in Singapore and i am a happy woman today? and i told my self that any lender that rescue my family from our poor situation, i will refer any person that is looking for loan to him, he gave me happiness to me and my family, i was in need of a loan of S$250,000.00 to start my life all over as i am a single mother with 3 kids I met this honest and GOD fearing man loan lender that help me with a loan of S$250,000.00 SG. Dollar, he is a GOD fearing man, if you are in need of loan and you will pay back the loan please contact him tell him that is Mrs Sharon, that refer you to him. contact Dr Purva Pius,via email:(urgentloan22@gmail.com) Thank you.

BORROWERS APPLICATION DETAILS

1. Name Of Applicant in Full:……..

2. Telephone Numbers:……….

3. Address and Location:…….

4. Amount in request………..

5. Repayment Period:………..

6. Purpose Of Loan………….

7. country…………………

8. phone…………………..

9. occupation………………

10.age/sex…………………

11.Monthly Income…………..

12.Email……………..

Regards.

Managements

Email Kindly Contact: urgentloan22@gmail.com

Hello Everybody,