I've seen this question pop up a lot in one form or another. So, first let's have a little vocabulary lesson.

The

budget is when the government plans where to spend money and how much to spend for the fiscal year. This isn't concrete. The government can over or under spend in areas just like you or I.

The

deficit is when the government spends more money than it takes in.

And the

debt is when the government borrows money to account for the money it overspent.

When a country doesn't have a deficit, this does not mean that leftover money automatically goes toward the debt. The government has to decide to what to do with that extra money, and it could just as easily (and probably more likely) be spent on something else than go toward the debt.

For 2015, the US is estimated to have a deficit of

$583 billion and a debt of

$18.6 trillion.

General Provisions

I don't know what Bernie Sanders plans to do about this in the way of specifically setting aside money to pay back the debt or putting in careful calculations to make sure we don't have a deficit. But I do know he's looking for specific ways to cut spending.

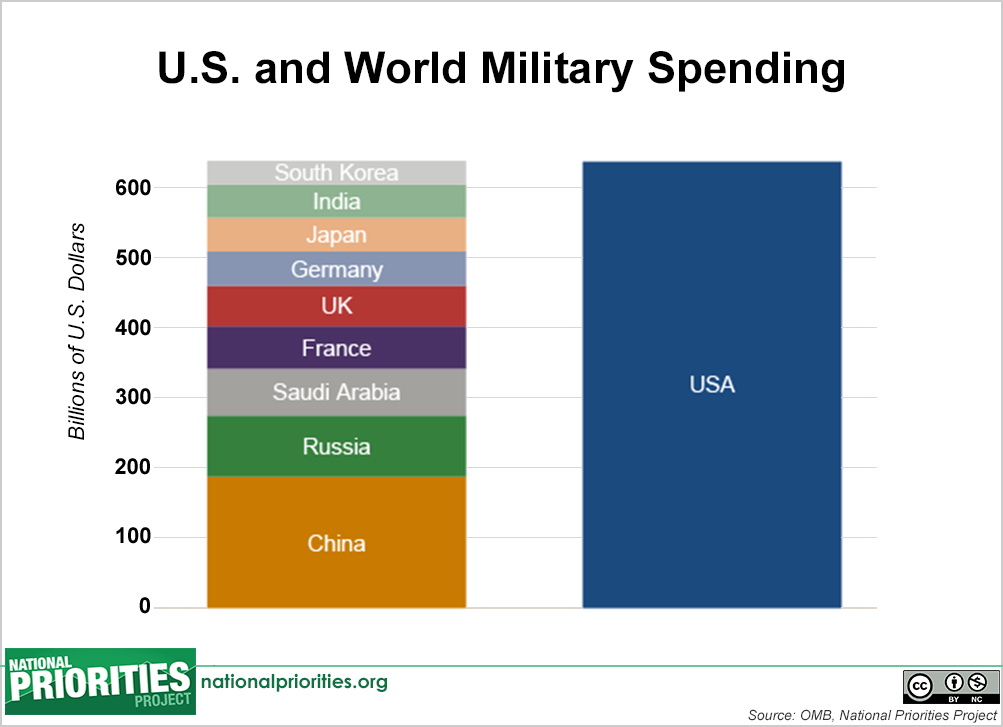

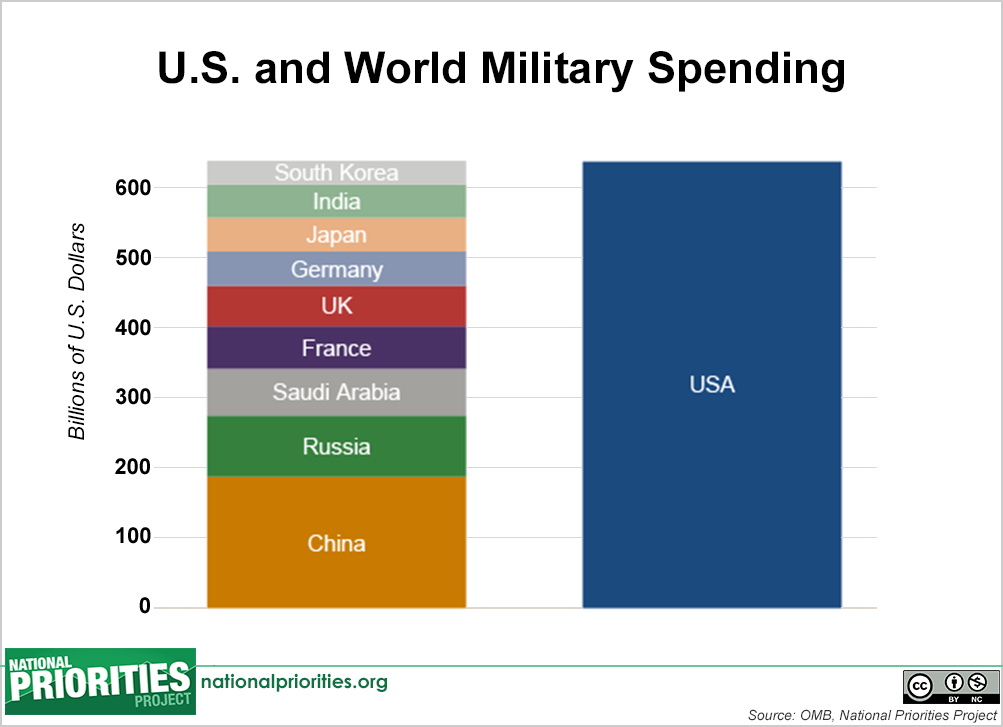

Military Spending

We currently spend more money in military spending than the next 9 countries combined. The Military budget for 2015 was

$598.5 billion. Bernie Sanders

wants to cut that. He hasn't said how much, but we could cut the budget by 60% and still lead the world in defense spending. If we did that, we'd have $359.1 billion in savings.

|

| https://www.nationalpriorities.org/campaigns/us-military-spending-vs-world/ |

Mass Incarceration

The

2.4 million people we imprison in this country, costs us

$80 billion a year. If we ended the War on Drugs and gave people medical treatment instead of putting them behind bars (as

Bernie Sanders wants to do), this would cut our prison costs by over half, saving

$41.3 billion a year. (Ah! You say. But what about health care costs? We'll get there.) This would also save money in welfare costs as

about half of US states provide welfare for convicted felons who struggle to find jobs once released.

Ending Off Shore Tax Havens

Bernie Sanders wants to put an

end to offshore tax havens, which allow corporations and rich Americans to store money overseas. They then pay less taxes to other countries, which costs the federal US government $150 billion year and state governments a total of $39.8 billion a year (

source).

Ending Corporate Welfare

No one knows for certain how much money is paid to corporations each year in subsidies, but it's estimated to cost

$110 billion a year. The top 8 paid corporations (such as Boeing, Nike, Shell, and Intel) made up $22 billion of that cost last year. (And while you're at it, here's a

Top 30 list.) A number of these companies are Fortune 500 companies that don't need government handouts, and some of them aren't even US companies (

source). Bernie Sanders

isn't against business, but he

is against giving tax payer dollars to corporations that already making millions or billions of dollars in profit.

Raising the Minimum Wage

It's estimated that

$152.8 billion a year is spent in taxes on welfare programs for minimum wage employees who

don't make enough to support themselves or their families. Raising the minimum wage to

$15 an hour would eliminate that cost.

Tax Reform for the Rich

No one knows the exact numbers, but it's estimated that

25% of millionaires and at least the

top 400 billionaires pay less in taxes than the average middle class American. Bernie Sanders

wants to fix this by raising income taxes on the richest Americans, abolishing tax cuts for millionaires and billionaires, and changing the cap on and raising the estate tax. It's estimated reform on the estate tax alone would bring in

$31.9 billion a year. We don't currently have numbers for the other areas.

Tax Wall Street

Bernie Sanders wants to implement a

Financial Transaction Tax (a.k.a Robin Hood Tax), which is a small tax (.003%) on each transaction of a stock or bond. This would bring in $35.2 billion a year.

Specific Programs

The following includes a number of programs that Bernie Sanders wants to implement a discussion on how they may or may not contribute to deficit. You can read more specifics about these bills in a

previous post.

Green Energy Initiatives

The

Climate Protection Act and

Sustainable Energy Act implements a number of green energy initiatives. This would be paid for by implementing a $20 carbon tax per ton of carbon emissions, rising by 5.6% per year over 10 years. The bill would also end fossil fuel subsidies. The revenue from these bills would generate approximately $300 billion to go specifically toward debt reduction.

Tuition Free College

Bernie's

College for All Act would be paid for by taxes on Wall Street. While the bill costs $47 billion, the taxes on Wall Street is projected to bring in hundreds of billions of dollars a year. And extra revenue could be used elsewhere.

Create Jobs Rebuilding America's Infrastructure

Bernie Sanders'

Rebuild America Act would cost $1.6 Trillion (paid for by the development of a National Infrastructure Development Bank that would then give out loans). However, this bill would presumably provide jobs for those who are unemployed, saving in welfare costs. This bill would also build up our infrastructure to allow it to compete with the rest of world. A

study by Duke University estimates that every dollar spent into transportation infrastructure pays back $3.54 in economic impact. It's not clear how exactly this would impact the deficit, but it's information worth having.

Health Care

I don't know how much Bernie's

American Health Security Act would cost (someone smarter than I will have to look at it). But is it estimated that the US spends

$3.1 trillion on health care. That includes

$374 billion in prescription costs, which Bernie

wants to lower. It also includes

$836 billion in Social Security costs for Medicare, Medicaid, Children's Health Insurance (CHIP). The American Health Security Act would replace these programs along with Federal Employee Health Benefits (FEHB), TRICARE, and provisions under the Affordable Care Act.

Whatever the cost of Bernie's American Health Security Act, it's important to note that its cost wouldn't go on top of what the US already spends in health care. The American Health Security Act would absorb the programs we already have. In effect, the money the government currently spends in health care programs would simply be transferred to the American Health Security Act, and our previous health care programs would be eliminated. So, one way or another, the cost of this new bill should come out as a general wash.

Conclusion

Bernie Sanders has a lot of changes he wants to make for America. It's easy to take them at face value and miss the cost savings underneath. Pass this article around for those who have questions.

UPDATE 09/19/15: Added more headings and a more of Bernie's programs

Lincoln Chafee hails from Rhode Island. Iconic Rhode Island drinks include the Rhode Island Red Cocktail, Coffee Milk, and Rhode Island Ice Tea.

Lincoln Chafee hails from Rhode Island. Iconic Rhode Island drinks include the Rhode Island Red Cocktail, Coffee Milk, and Rhode Island Ice Tea. Hillary Clinton

Hillary Clinton

Bernie Sanders

Bernie Sanders Maple is staple in Vermont. There's tons of recipes for maple bread. My personal favorite was this recipe topped with soft cheese. Finish with a toothpick.

Maple is staple in Vermont. There's tons of recipes for maple bread. My personal favorite was this recipe topped with soft cheese. Finish with a toothpick.